2022 Public Sector Tender Thresholds

Procurement thresholds for public sector tenders are updated for 2022. Associate Consultant, Carl Rogers, is an expert on public procurement. In this post he explains the changes and the importance of contract values.

Timings

The new procurement thresholds affect new tenders from 1st January 2022.

Why are Procurement Thresholds Important?

Public sector buyers must be aware of these thresholds. These are the values above which an advert must be placed to ensure competition. Failure to do so can result in legal action being taken against the contracting body.

The procurement thresholds are applicable to public purchasing. This includes government departments, local authorities, NHS Trusts, utilities, housing associations etc. They cover the following:

- The Public Contracts Regulations 2015

- The Concession Contracts Regulations 2016

- The Utilities Contracts Regulations 2016

- The Defence and Security Public Contracts Regulations 2011

See also EU Procurement Rules 2014 which brought in changes to ensure better value for money and improved quality. The reduction of red tape makes it easier for small and medium-sized businesses (SMEs) to tender. Post-Brexit the EU rules were transcribed into UK law in the form of the regulations mentioned above.

What has changed

Whilst it looks like the thresholds have increased, the new thresholds now take into account VAT. But opportunities are still advertised excluding VAT.

It is a bit confusing. The thresholds do not contain VAT as such. However, when the contracting Authority is planning a tender exercise, they must calculate the value in the normal way. Then add 20% VAT. If the VAT inclusive value exceeds the threshold, then the contracting Authority must publish their opportunity on the Find a Tender Service (FTS). However, they then must publish the opportunity in FTS without the 20% included.

Even though the thresholds appear to have increased, when the VAT is factored in, they have actually decreased.

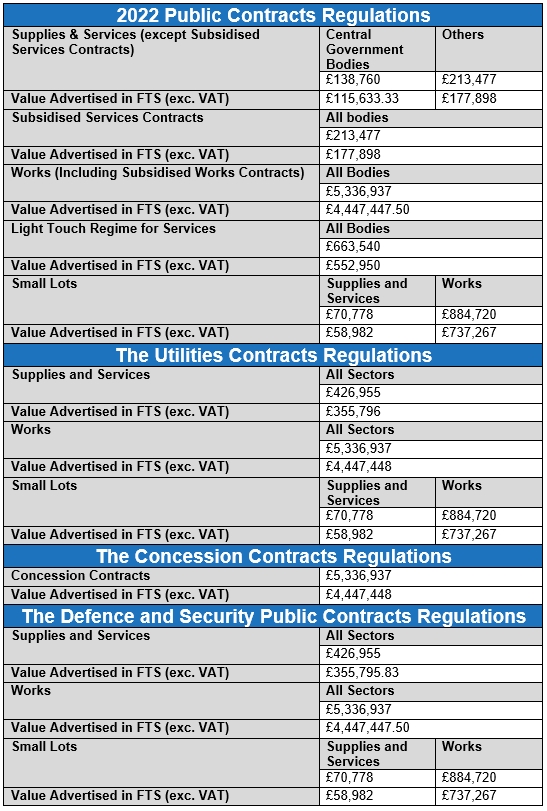

The table below shows the new thresholds for 2022, including and excluding VAT:

How to Find Public Sector Tenders

Read our guide on finding public sector tenders. It explains how to use the Find a Tender Service (FTS), Contracts Finder and other public-sector procurement portals to find tenders.

How are Contract Values Calculated and What are the Problems?

This is a simple enough question but one which some struggle with. Many people look at contracts in annual terms; that is logical as we budget annually. But, in the past, this has been used, whether intentionally or not, as a ploy to get around complying with the requirements of the regulations.

Therefore the rules have been tightened to cover this and now contract values are based on the whole-life cost.

For example, some have said that a contract for goods or services with an annual spend of £50k is below the threshold. Arguing that minimum procurement timelines do not apply. And an advert does not have to be placed. But this contract, for say 5-years, has a potential total contract value of £250k. Making it within scope of the above threshold procurement regulations for goods and services.

Public sector buyers must try and calculate the maximum potential contract value and use that. Where there is no contract in place, an estimation of annual value needs to be created. It is then multiplied by the maximum contract length (including any extensions). This may be based on past purchases or spend over a number of years so that if questions are asked, the estimate can be justified.

Concessions contracts are where the supplier makes money from the right given by a Contracting Authority to provide, rather than the Authority paying. For example, bailiff services where the enforcement agency collects penalties on behalf of a council. Concession contract values are based on what it is worth to the supplier or the cost an authority would incur to provide the contract.

If putting a figure together proves difficult, a range can be applied with a lower and upper-value banding.

Why are Contract Values Important?

Failure to get it correct can lead to the requirement of having to re-tender the contract early. This is due to the stated value having already been reached. With stretched resources, this is hassle that public authorities can do without. Let alone the potential unfavourable publicity and risk to potential supplier relations.

Another pitfall is where a supplier challenges the contract on the basis that if they had known the contract value was going to be higher, they would have put in a bid. Importantly, they don’t have to prove that they would have been awarded the contract, only that there has been a procedural breach.

So, public sector procurement professionals must pay attention to the thresholds and get contract values correct. Or at least have a transparent methodology for their estimate.

Brexit

From 31st January 2020, the UK was no longer be subject to the EU procurement directives regime. Read my other article about Brexit and public sector tenders.

If you need help with any aspects of tendering, contact us for an informal discussion about getting professional support.

Summary

Public sector procurement threshold levels have decreased slightly for 2020 for high-value tenders. That is due to taking into account 20% VAT.

Procurement thresholds are driven by correctly calculating contract values over the typical contract term. Failure to get this right has serious consequences.

If you have any thoughts on public sector procurement, please add them in the comments box below.